Understanding Property Titles in Australia: A Complete Guide

Introduction: Why Understanding Property Titles Matters

In Australia, property ownership is much more than simply holding the keys. Understanding property titles is essential for anyone buying, selling, or investing in real estate.

Clear title knowledge can save you from future disputes and expensive legal battles. If you ignore this critical step, you might face unexpected complications. This article explores all you need to know about property titles in Australia, equipping you for every transaction.

What Are Property Titles in Australia?

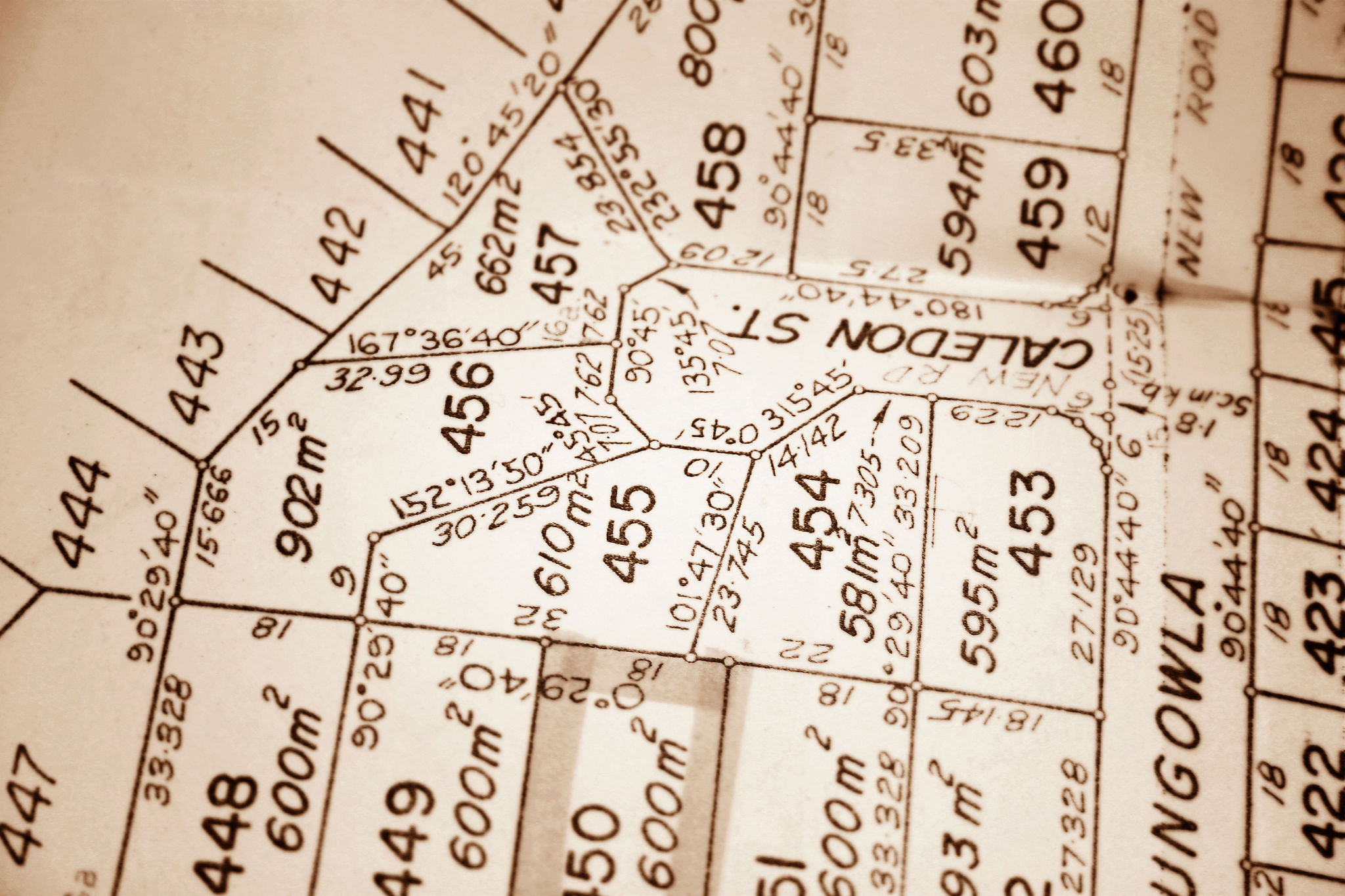

A property title is a legal document. It shows who owns a particular piece of land or real estate. In Australia, the title also records interests, rights, and obligations over the property. Every title tells a unique story, containing details that distinguish one property from another. Checking the title gives a clear overview of any restrictions and encumbrances, such as mortgages or easements.

Torrens Title System: The Standard in Australia

Australia primarily uses the Torrens Title system. Under this model, ownership is guaranteed by the government. This system brings reliability and transparency for buyers and investors. Each Torrens Title is registered in the state or territory’s land registry, offering one single source of truth for property details.

Key Features of the Torrens Title System

Government guarantees the validity of each registered title.

Changes to ownership and interests require registration in the official land registry.

The register is conclusive; what appears on the register is legally binding.

Torrens title provides certainty, giving owners peace of mind.

If you want more insights on land registry and Torrens system, check the resources at Mint Legal’s blog.

Types of Property Titles in Australia

Freehold Title

Freehold, the most common title, means full ownership of land and structures. Owners can sell, lease, or develop the property, subject to local council rules.

Leasehold Title

Unlike freehold, leasehold properties grant ownership for a specified period only. This is more common in states like the Northern Territory and the Australian Capital Territory, and in some specialized developments. After the lease expires, the land typically returns to the original owner.

Strata Title

Strata titles cover apartments, units, and townhouses. Owners get exclusive rights to their unit, plus shared rights over common areas such as gardens, pools, or hallways. Strata titles require you to join the owners’ corporation, with rules and fees set for maintenance and management.

Community Title

Community titles are similar to strata but can cover larger developments, including residential, commercial, and recreational properties. These require owners to share responsibility for community assets, such as roads, tennis courts, or clubhouses.

Company Title

Company titles are rare but still exist, mainly for older blocks of flats. A company owns the building. Buyers purchase shares in that company, granting them the right to occupy a unit.

Common Encumbrances Found on Property Titles

Buying property without checking for encumbrances is risky. An encumbrance is a registered interest that limits or affects the property.

Types of Encumbrances:

Mortgages: The most common, protecting the lender’s financial interest.

Easements: Rights for others to access a portion of land (e.g., for utilities or pathways).

Covenants: Restrictions placed on how you can use the property, such as building limitations or design rules.

Caveats: Legal warnings that someone else has a claim or interest in the property.

Always review the title thoroughly before purchasing, or consult a professional at Mint Legal for expert help.

Title Searches: A Must for Buyers

A title search is a formal process. It reveals property ownership, encumbrances, and any other official interests. Before finalising any property deal, conduct a title search through the relevant state or territory land registry office. Key details provided include the owner’s name, property description, and all registered interests. This helps prevent fraud and reduce risk in property transactions.

Differences Across Australia’s States and Territories

While the Torrens system operates across the country, each state and territory has its own land registry and requirements.

New South Wales (NSW)

Managed by NSW Land Registry Services.

Digital conveyancing through the PEXA platform is now standard.

Victoria

Title management is handled by Land Use Victoria.

Most documents have transitioned to electronic lodgment.

Queensland

The Titles Registry is overseen by the Department of Resources.

Both paper and digital transactions are accepted.

Western Australia

Managed by Landgate.

Most title dealings require verification of identity and electronic conveyancing.

Other states and territories follow similar rules, but always check the current requirements, as reforms frequently improve and digitise these processes. For updates, Mint Legal’s blog keeps buyers and investors informed.

Why Accurate Title Checks Prevent Costly Mistakes

Mistakes on a property title can be costly. Errors may result in disputes, loss of land, or difficulties with finance approval. Regular checks and using a trusted conveyancer or solicitor ensure the title reflects your current rights and interests.

Understanding Tenancy Types: Joint Tenants vs Tenants in Common

Properties owned by more than one person usually appear as either joint tenants or tenants in common.

Joint Tenants: Each has an equal share. If one owner passes away, the share automatically transfers to the surviving owner.

Tenants in Common: Shares can be unequal. Each owner can leave their share to anyone in their will.

Choosing the right structure impacts future ownership and inheritance, so seek legal advice if unsure.

Electronic Certificates of Title: The Digital Shift

Most jurisdictions have moved or are moving from paper certificates to electronic titles. This digital format simplifies transfers, settlements, and mortgaging. E-titles are protected with advanced security methods, reducing the risk of physical loss or forgery. The move supports efficient, paperless conveyancing processes.

Common Hazards and How to Avoid Them

Unregistered Dealings

Some interests or agreements, like unregistered leases, may not appear on the title. These can be risky. Always ask for full disclosure and supporting documentation.

Boundary Issues

Boundary mistakes happen more often than you think. Sacrificing accuracy during surveys can cause future neighbor disputes. When in doubt, commission a new survey and seek professional advice.

Illegal Building Works

If past renovations weren’t approved or recorded, you may inherit hefty penalties. Review local council records to check compliance and approval history before buying.

Role of Solicitors and Conveyancers in Title Matters

A solicitor or licensed conveyancer plays an essential role when handling titles. They conduct searches, advise on encumbrances, and ensure proper registration. Their expertise protects you from undisclosed title defects and future claims. Engaging a professional guarantees that the transaction is legal and safe.

Updating and Transferring Property Titles

When property ownership changes, the title must be updated or transferred. This occurs:

- After a sale or purchase

- Following inheritance or family court order

- Upon establishing trusts or corporate entities

Each transfer involves formal processes, including preparing legal documents and registering updates with the government. If you need practical guides, Mint Legal’s blog provides valuable resources.

Frequently Asked Questions About Property Titles

Q: Is a property title proof of absolute ownership?

A: The registered title shows legal ownership and interests, but it’s vital to check for outstanding encumbrances.

Q: Can title details change without my knowledge?

A: Generally, changes require your signature or notice. Never ignore correspondence from land registries or authorities.

Q: How do I protect myself from title fraud?

A: Stay vigilant. Keep personal details secure and monitor your title for unusual activity. Lawyers and conveyancers provide an extra layer of defense.

The Connection Between Titles, Mortgages, and Finance

Most banks won’t lend without a title search confirming good title. The registered title is the backbone of property finance. If issues appear, banks may withhold mortgages until resolved. For detailed steps on securing property finance, review our guides at Mint Legal.

Common Myths About Property Titles in Australia

Myth: “A title search is not necessary.”

Reality: Skipping a title search can leave you vulnerable to undiscovered problems or claims.

Myth: “Title insurance covers all risks.”

Reality: Title insurance covers many—but not all—risks. Always read policy details.

Myth: “Property titles never change.”

Reality: Ownership, interests, or government actions can change titles. Keep records up to date.

Action Steps for Buyers and Investors

- Always conduct a full title search before buying.

- Confirm there are no outstanding encumbrances or legal issues.

- Use a qualified solicitor or conveyancer.

- Stay informed about changes in property law and title registration.

- Consider checking the latest legal articles and how-to guides at Mint Legal’s blog.

Conclusion: Secure Your Investment with Proper Title Knowledge

Understanding property titles in Australia is vital for making informed, risk-free investments. Whether you are buying your first home or managing a property portfolio, stay methodical and proactive. Never overlook the power of due diligence.

For guidance, updates, and legal support, visit Mint Legal’s blog to keep your property journey secure and successful.